rental income tax malaysia 2017

You pay 1 on the first RM. 20172018 Malaysian Tax Booklet.

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following.

. Rental income tax malaysia 2017 Https Www Pdfrun Com Form 1040 Schedule E 2017 Tax Forms Federal Income Tax Income Tax 2 A Guide On Rental Income Tax For Residential Properties. On the First 5000 Next 15000. Key Malaysian Income Tax Info Do I need to file my income taxYes you would need to file your income tax for this past year if.

Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents commission. Useful reference information on Malaysian Income Tax 2017 for year of assessment 2016 for resident individuals. Total annual income Tax Exemptions Tax Reliefs RM 63000 RM 1400 RM 9000 RM 4400 RM 48200.

Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. Malaysias prime minister presented the 2018 Budget proposals on 27 October 2017 and announced a slight reduction in individual income tax rates and partial exemption of rental. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia.

On the First 5000. Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service charge sinking fund and management fees are deductible. Its paid on either the sale value or the official market value - whichever is higher.

4 Rental income earned by nonresident individuals is taxed at a flat rate of 25. Sunday December 31 2017 50 Tax Exemption for Rental Income Malaysia 2018 All rental income received are taxable under personal income under Seksyen 4d Akta Cukai. Mozzie November 27 2011.

The exemption is not restricted to just one. Azrie owns 2 units of apartment and lets out those units. Rental income is taxed at a flat rate of 24.

7 December 2017. The rate is set progressively. Rental income received by Malaysian resident individuals not exceeding RM2000 per month for each residential home Comment.

Item 2 and 3 are something new comparing to the assessment year before. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060 Her chargeable income would fall.

The tax is calculated based on the annual rental value of the property which is then multiplied by a fixed rate. This tax is usually paid by the buyer. A much lower figure than you initially though it would be.

3 Tax Relief for Childcare fees to a Child Care Centre or a Kindergarten Limited to RM1000 For the assessment year 2017 item 1 iv is a come back from the year 2010-2015. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in. The rental income commencement date starts on the first day the property is rented out whereas.

3 Estimated values. Calculations RM Rate TaxRM A. This can range anything from 2 to 9 depending on whether.

Depreciation does not qualify for tax deductions against income and capital allowances are not available for residential and commercial buildings. This publication is a quick reference guide. Previously tax relief for the purchase of a personal computer was RM3000.

Assessment Year 2016 2017 Chargeable. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

Newsletter 24 2017 Taxation Of Real Estate Investment Trust Or Property Trust Fund Page 002 Jpg

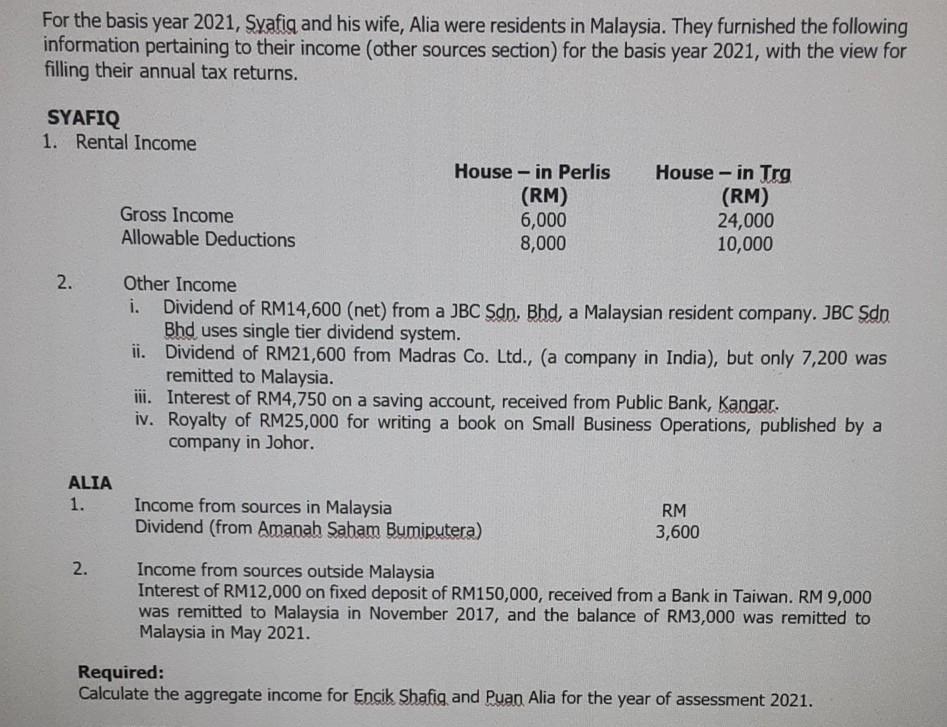

Solved For The Basis Year 2021 Syafiq And His Wife Alia Chegg Com

Rental Activity Loss Rules For Real Estate Htj Tax

Pdf The Effects Of House Price And Taxation On Consumers Burden The Case Of Malaysia

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Tax Exemption For Rental Income 2018 Donovan Ho

How To Calculate Rental Income Tax For Non Residents Foreigner

How To Compute And File Taxes For Your Rental Income Kclau S Webinar

Pdf Property Tax Management Model Of Local Authorities In Malaysia

Investment Analysis Of Portuguese Real Estate Market

Assessing Progress Towards Sustainable Development Goal 3 8 2 And Determinants Of Catastrophic Health Expenditures In Malaysia Plos One

Tax Planning Budget 2017 From The Tax Perspective The Edge Markets

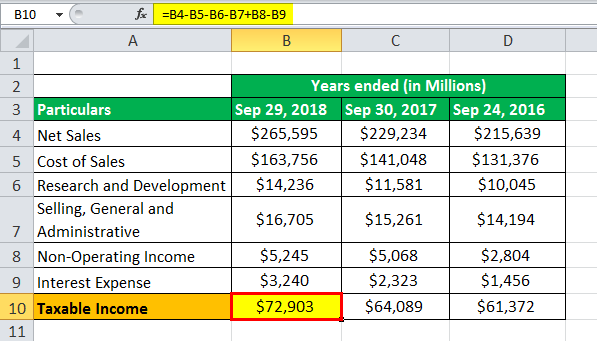

Taxable Income Formula Examples How To Calculate Taxable Income

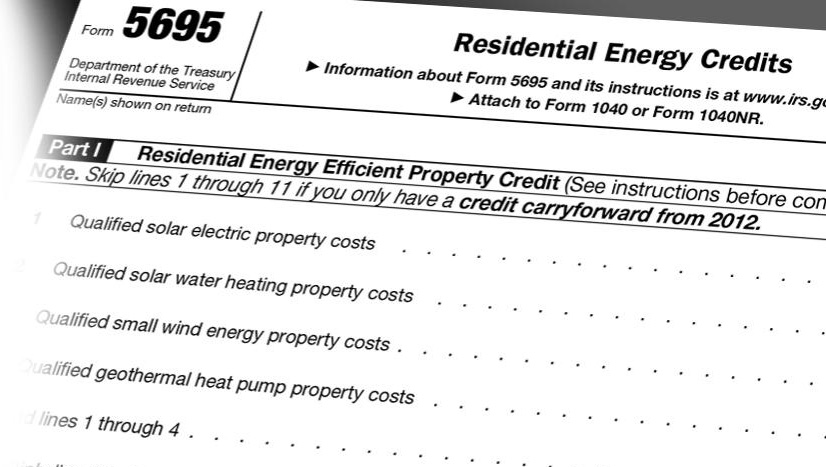

Solatube Tax Credit Info Daylighting System Solar Powered Fan

Rental Activity Loss Rules For Real Estate Htj Tax

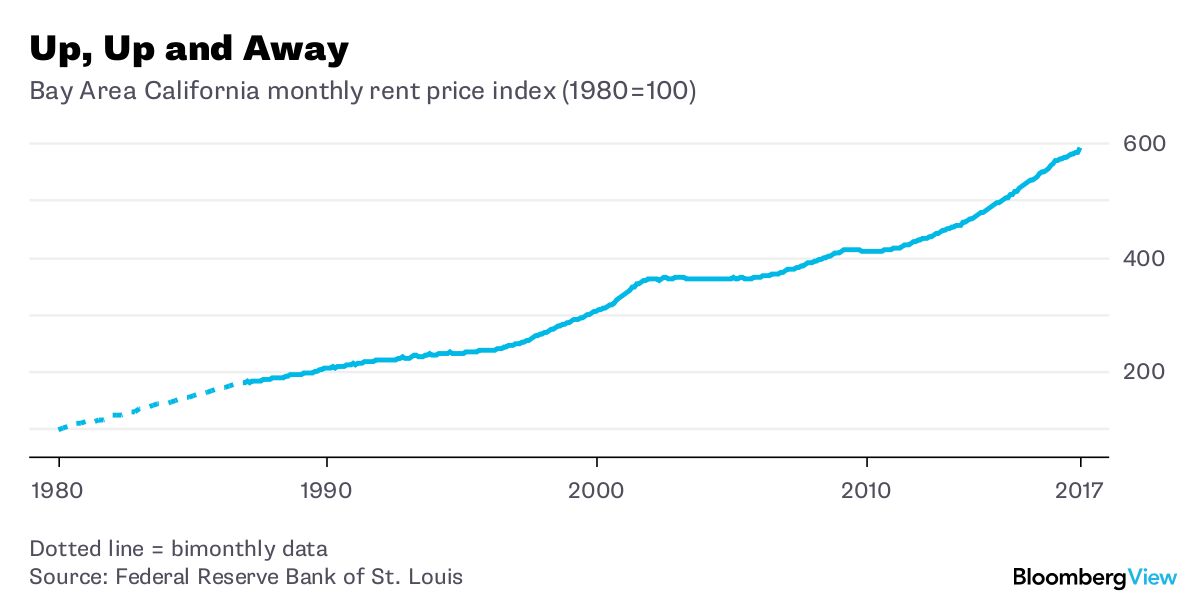

Yup Rent Control Does More Harm Than Good Bloomberg

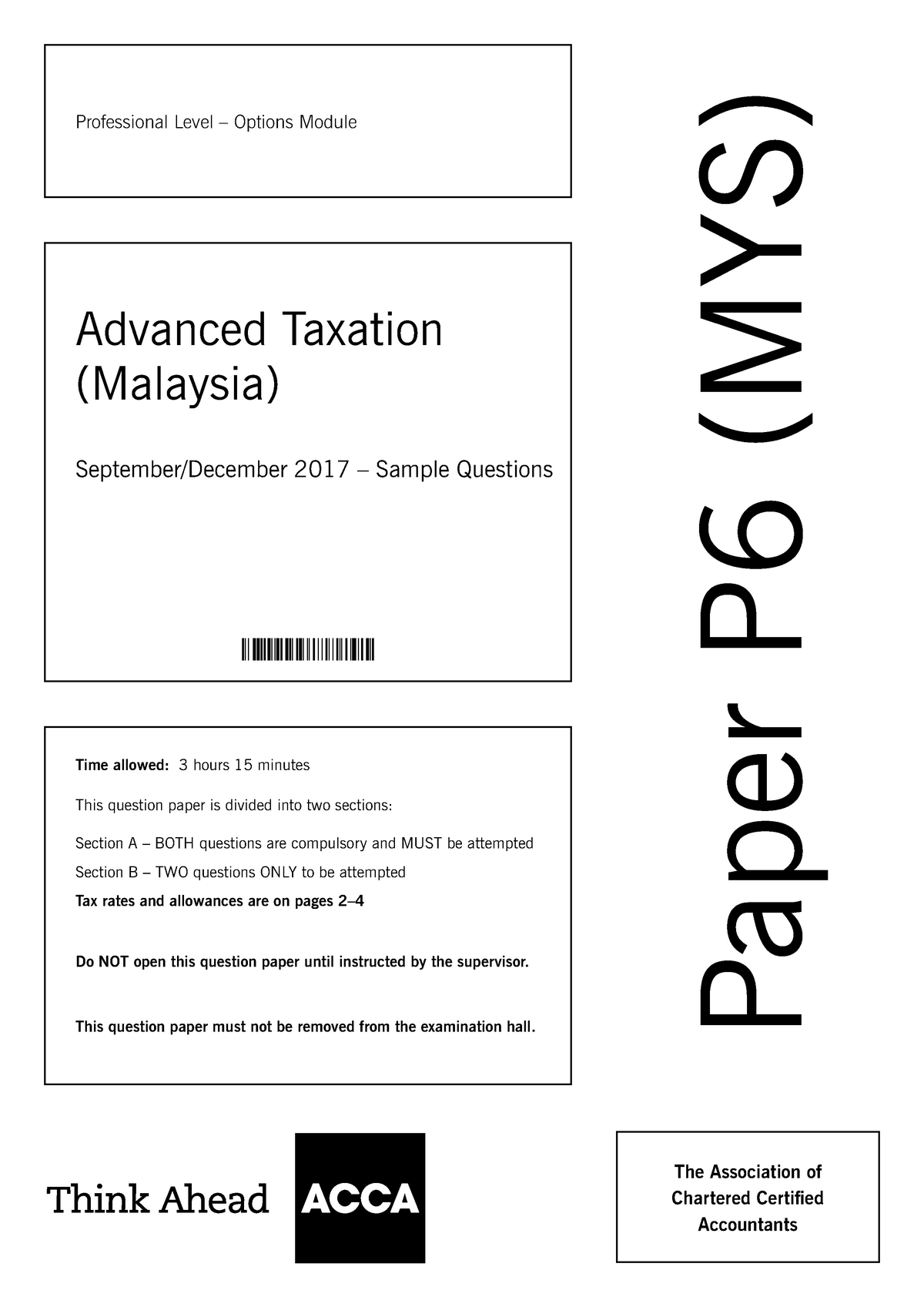

Sept Dec 2017 Q Qqqqqqqqqqqqqqqqqqqqqqqqqq Professional Level Options Module Advanced Taxation Studocu

How To Efile Your Income Tax Return And Wealth Statement Online With Fbr Toughnickel

Lease Accounting Software Ifrs 16 And Asc 842 Cch Tagetik Wolters Kluwer

Comments

Post a Comment